How to Earn Pounds on Your Naira Investments

Imagine walking through Balogun Market in Lagos. The sun is blazing, traders are busy haggling prices, and the one phrase you keep hearing is, "Dollar ti n ga!" (The dollar is rising!) Even Mama Chidinma, who sells fruits at her stall, knows when the dollar rate spikes and she adjusts her prices accordingly because the dollar is a second currency in Nigeria. But amidst all the talk about the dollar, there’s another currency quietly holding its ground—one that's stronger and more stable: the British Pound.

In today’s global economy, where money flows in and out of Nigeria through various channels like digital wallets and bank accounts, it’s no longer news that foreign currencies are a big part of our financial landscape. While the U.S. dollar has long been the focus, affecting everything from electronics to the tomatoes in your stew, the British Pound also offers an alternative. And now, you can save and invest your money in pounds, right from the comfort of your home.

Why the British Pound?

Let’s consider the recent trend. Since May 2023, when the Naira became a floating currency, we’ve all witnessed its dramatic decline in value. Just imagine—on January 1st, 2024, £100 was equivalent to ₦148,224. Fast forward to September 27th, 2024, and that £100 is now worth about ₦227,000. That’s over 53% increase in just a little under nine months! While the Naira continues to devalue, the British Pound remains a pillar of strength and stability and has risen by 5.5% against the dollar, in the same period.

Investing or saving in pounds is not just a smart move; it’s a strategy to protect your hard-earned money from currency devaluation. By diversifying your investments into pounds, you’re taking a solid step towards beating inflation and securing your financial future.

The Power of Diversification

Diversification has long been a tool for growing wealth. A farmer plants different crops to ensure a harvest regardless of the weather conditions, and spreading your investments across multiple currencies can safeguard your financial future against unforeseen economic downturns. Technology makes this easier than ever—you can save and invest in foreign currencies without leaving Nigeria.

How to Start Earning Pounds on Your Naira Investments

Now that you understand the benefits of saving and investing in pounds, let’s break down the steps to get started:

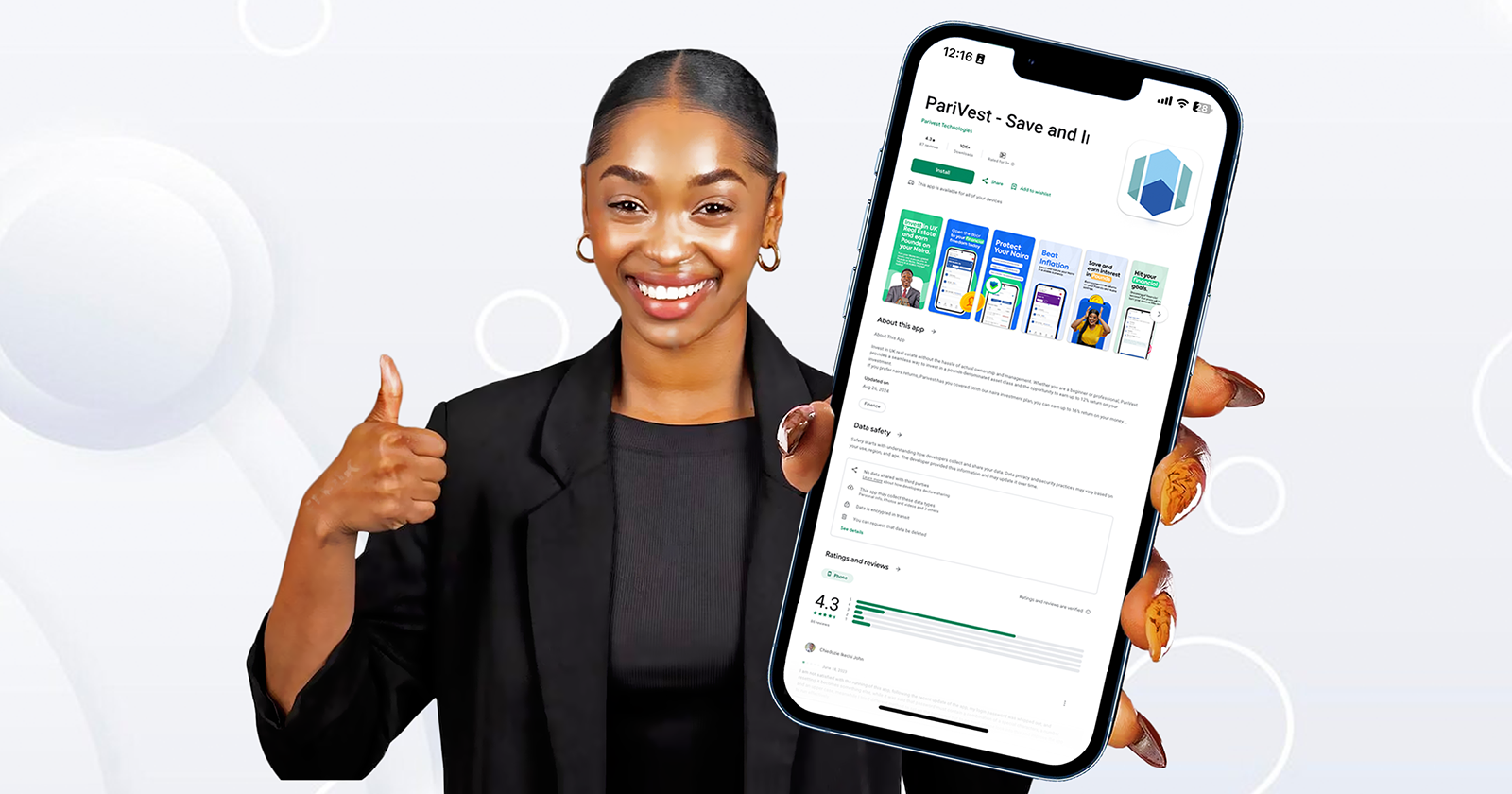

1. Download the PariVest App from the Play Store or App Store.

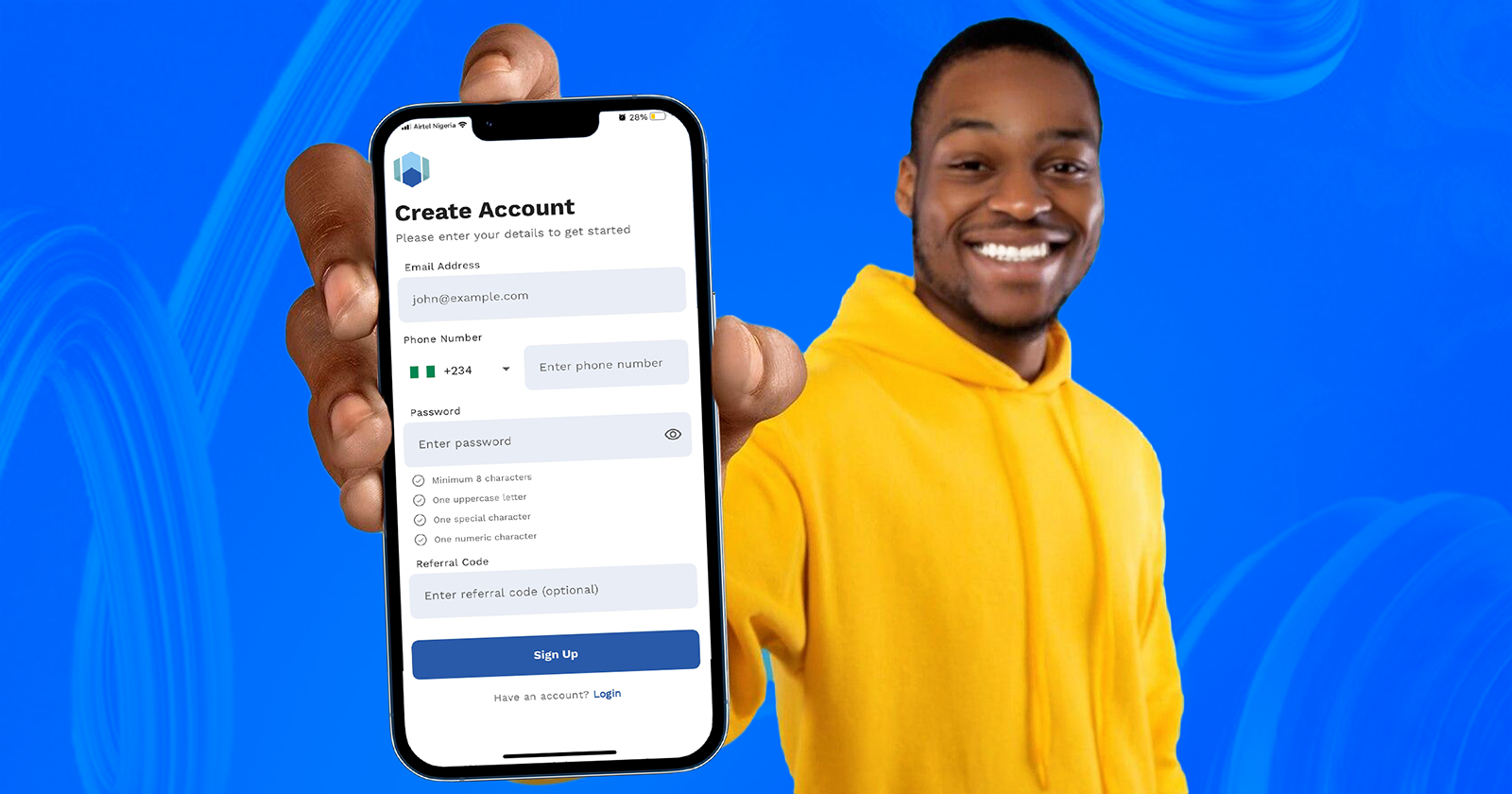

2. Complete Your registration process in just a few minutes.

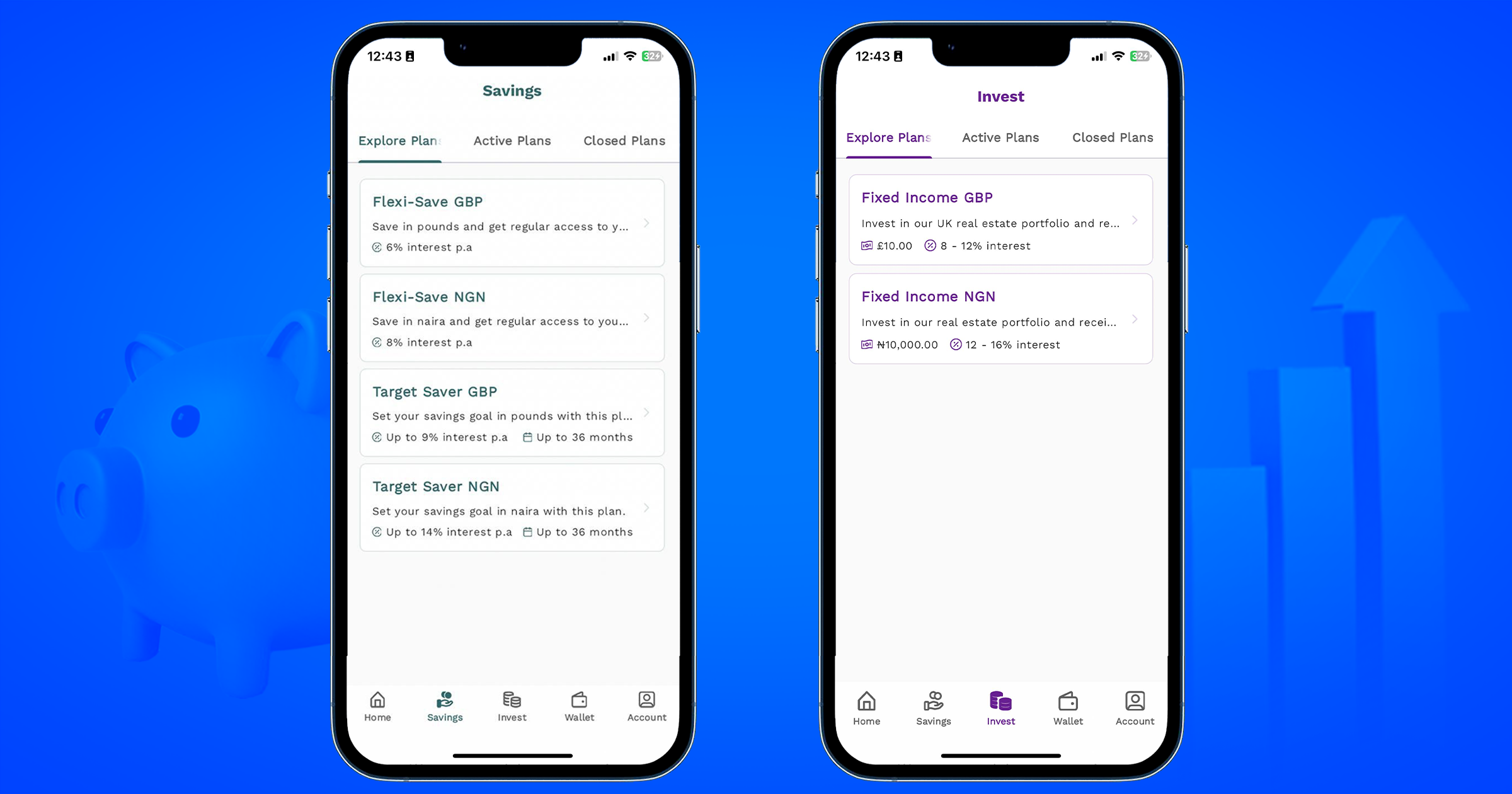

3. Fund Your Wallet with Naira.

4. Start Saving and Investing in Pounds. With your wallet funded, you can begin saving and investing in pounds. What’s more, you can earn up to 12% interest in pounds! That means your money isn’t just sitting idle—it’s growing daily.

As we navigate through a world where currency fluctuations can impact every aspect of our lives, securing your financial future through strategic investments in stable currencies like the British Pound is a wise move. Follow these simple steps to protect your money from devaluation and watch it grow in one of the world’s strongest currencies.

So, why wait? Start today, and let your naira earn you pounds.