How Nigeria’s New Tax Landscape Impacts Global Investors in UK Real Estate

Nigeria’s new tax reforms are reshaping how residents and non-residents are taxed — a shift with significant implications for investors managing assets or income across borders. For Nigerians investing in global markets, especially UK real estate, understanding the distinction between resident and non-resident taxation is no longer optional. It determines how much of your income is taxed, where it’s taxed, and how you can legally structure your investments to stay compliant and profitable.

Nigeria’s 2025 Tax Reforms: A Global Shift with Local Impact

Earlier this year, the Nigerian government signed the Tax Act 2025, replacing and consolidating several existing tax laws. The new framework refines how residency is defined, expands global income coverage, and strengthens cross-border data sharing — marking a clear shift toward tighter international alignment and enforcement.

The reforms mark a turning point in Nigeria’s fiscal policy — from focusing on domestic revenue to actively monitoring how citizens earn and invest abroad. For globally active Nigerians, the main consideration is how residency status shapes their exposure to taxation on international income.

Resident vs Non-Resident: The Core of Cross-Border Taxation

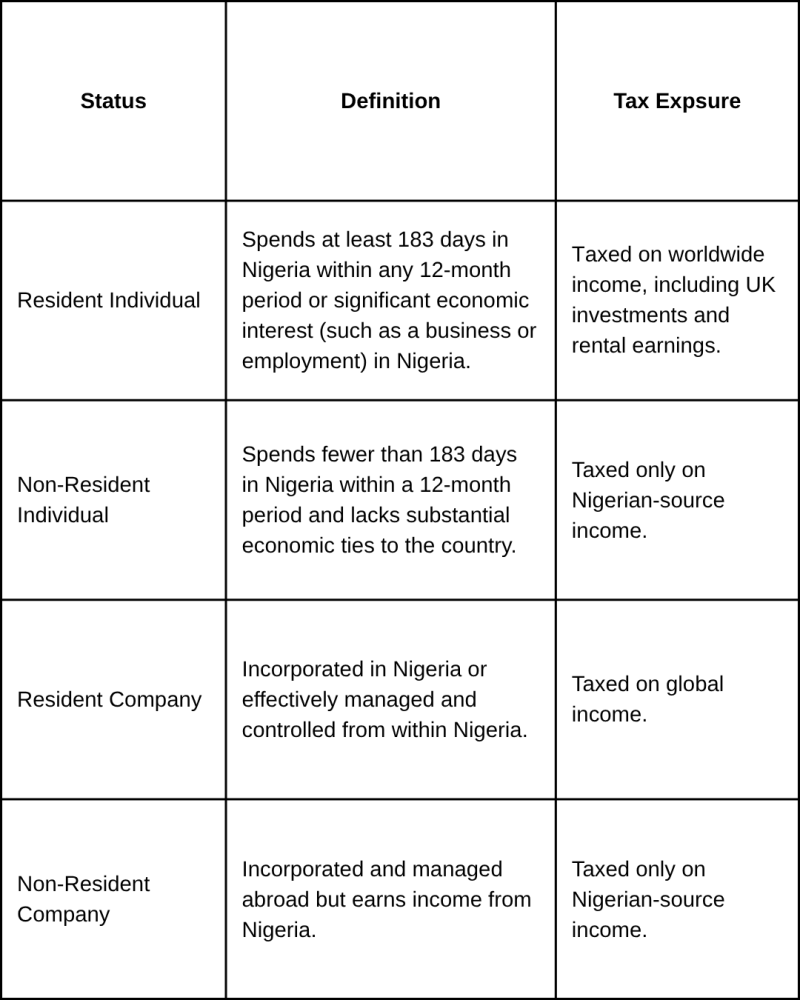

Under Nigerian tax law, residency determines the scope of your tax liability:

This distinction determines whether global income — such as rent, dividends, or capital gains from UK property — is taxable in Nigeria.

For example, a Nigerian investor who qualifies as a tax resident may need to declare UK property income on Nigerian tax filings. However, the Double Taxation Agreement (DTA) between Nigeria and the UK can help prevent the same income from being taxed twice.

Non-residents, on the other hand, are typically taxed only in the jurisdiction where the income arises. That means Nigerian investors who live and earn primarily abroad, and can prove non-residency, will generally have their UK property income taxed in the UK alone.

Why the UK Property Market Remains a Magnet for Global Capital

Despite Nigeria’s evolving tax rules, UK real estate continues to attract significant global investment. Institutional and private investors view it as one of the most stable and transparent property markets, supported by undersupply, consistent rental demand, and strong infrastructure.

For Nigerian investors, this sustained interest by institutional funds signals that UK property remains a dependable asset class — one that continues to generate competitive yields even amid tighter tax regimes.

Aligning Tax Awareness with Investment Strategy

Taxation shouldn’t deter investment — it should guide smarter decisions. Understanding your residency status, income sources, and available treaty reliefs (like the UK–Nigeria DTA) helps investors make informed choices about compliance and long-term returns.

The Bottom Line

Nigeria’s 2025 tax reforms tighten how global income is tracked — a move that raises both compliance pressure and awareness for investors. For investors in UK real estate, the message is clear — understanding your residency status and how international tax treaties apply is essential to protecting your portfolio.

At PariVest, we help investors interpret these changes through a global lens — connecting opportunity with understanding. Because successful investing isn’t just about where your money goes, but how it’s managed across borders.