How We Manage Your Money

Have you ever wondered how we invest your money here at PariVest? This week, we put together some insight on how we manage your money together with our usual news briefing from UK and Nigeria.

How We Manage Your Money

When you invest money with us, the money goes directly to our Trustees, DLM Capital Trust company Limited, a registered SEC company. Their job is to ensure that your money is properly managed and is only used for the purposes we have stated in our contract with you.

The money is used to buy properties that are below the open market value of similar properties in the area. These properties would typically require some updating or full renovation to enhance their value. Once a property is purchased, our experienced team of builders set about renovating it to a high standard to achieve maximum value for reselling or rental. When the properties are sold, the funds are returned directly to the Trustee by registered solicitors who provide conveyancing services during the purchase and sale process.

For rental properties, we select carefully vetted property managers to manage the properties on our behalf. This, in a nutshell, is how we make sure that your money is safe at all times.

UK House Prices Continue to Surge

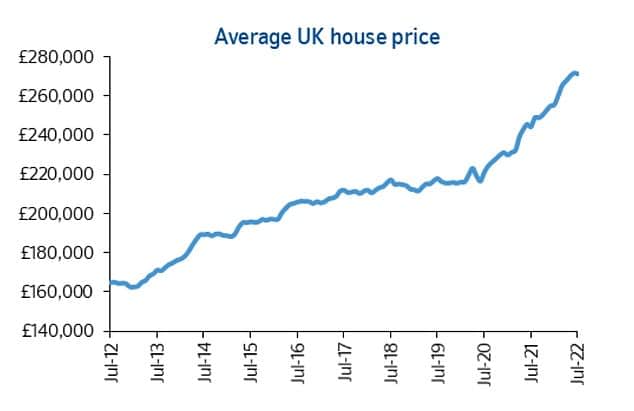

Back in the UK, house prices continued to surge hitting a 19-year high of 15.5% in July of this year with a typical home adding £39,000 in the 12 months to July. Despite rising interest rates and a cost-of-living crisis, high demand and low stock seem to be sustaining price rises.

The steep rise in July is a marked difference from June when prices grew by 7.8% year on year. Analysts believe that the rise in July was likely driven by the tapering down of a generous stamp duty holiday in July 2021 The UK government introduced a one-year stamp duty holiday in July 2020 during the covid pandemic that allowed home buyers to purchase properties without paying the normal stamp duty rate.

Although the rise witnessed in July may be a statistical anomaly, property prices continue to rise year on year albeit at a slower pace. There may be some headwinds for the market as the Bank of England continues to tighten monetary policy by increasing the base rate to tame inflation. The inflation rate reached 9.9% in September driven largely by higher energy costs. The increase in interest rates is likely to dampen demand for properties and may slow down or even reverse recent price rises. The good news is that wholesale energy prices have fallen significantly in recent weeks and therefore we expect this to feed into the rate of inflation in the coming months, thus reducing the chances of further interest rate rises.

Nigeria to Splurge on Debt…Again!

Back in early August, we told you about how type: embedded-entry-inline id: 7umQuS7WhnPMX19sY1ae9d. At the end of last month, the Minister for Finance and National Planning, Zainab Ahmed said that the Federal Government would need to borrow over N11tn and sell national assets to finance the budget for the 2023 fiscal year if the status quo in petroleum subsidy remains. According to her, the budget deficit is projected to reach N12,4tn in 2023, representing 196% of total revenue.

What we say:

The government needs to shift its focus to plugging the many leakages within the system, especially in the oil & gas sector. The country loses an estimated 700,000 barrels of crude oil per day. At an average price of $95 per barrel, that amounts to $24bn per annum or N10tn. This number does not include losses from the theft of natural gas or the plethora of revenue-collecting agencies that are poorly regulated in the country.

What’s Happening at PariVest

Here at PariVest, our early investors who invested with us 3 months ago when the Pound was trading at N750 to £1 are reaping the rewards of their investment. Apart from the high-interest returns that we pay, our investors have now earned N100 for every £1 of investment. Don’t you wish that you joined the winning team earlier? It’s not yet late.

We hope you’ve enjoyed this little nugget, if you did, kindly share and drop a comment below!